Bridging Finance

In a nutshell, a bridging loan is a short-term loan that can support the purchase of a property such as one that doesn’t match the criteria for a traditional mortgage. They can help between the sale of one property and the purchase of another or help landlords at risk of repossession. A bridging finance calculator can help you understand what you may be able to borrow.

What is a Bridging Loan and how can it be used?

Investors might consider taking out a bridging loan to help buy and renovate an uninhabitable property that would be normally be refused a mortgage and then take a mortgage out on it once the property is fit for purpose or sell it at its new higher value.

Bridging loans has also helped a lot of investors secure properties quickly as loans are approved within weeks days and sometimes hours. At auctions, when transactions generally need to be completed within one month, bridging loans can help to secure a property at lower than the market rate within the short time frame required. Our bridging finance calculator can be used for auction borrowing or property investment assessments.

Borrowers might want to think of a bridging loan as a short-term mortgage and they are similar in many ways. In both cases, the loan value is determined by the property value. As with every secured loan, assets are at risk if the borrower cannot repay the borrowed amount. There are good reasons to take out a bridging loan, but weighing up the bridging finance advantages and disadvantages is essential, as is consulting a bridging finance calculator to ensure you make informed decisions.

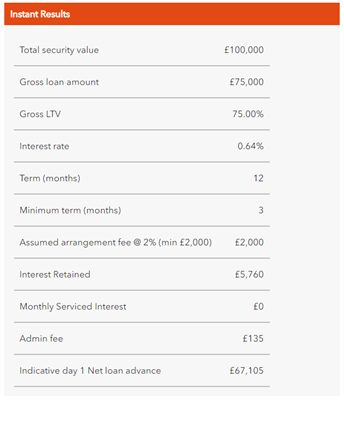

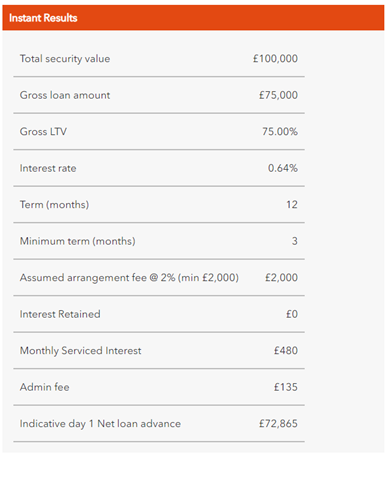

| Total security value | 0 |

| Gross loan amount | 0 |

| Gross LTV | 0 |

| Interest rate | 0 |

| Term (months) | 0 |

| Minimum term (months) | 0 |

| Assumed arrangement fee @ 2% (min £2,000) | 0 |

| Interest Retained | 0 |

| Monthly Serviced Interest | 0 |

| Admin fee | 0 |

| Indicative day 1 Net loan advance | 0 |

Further Reading

-

Auction Finance

-

UK Bridge to Let Mortgage Borrowing

-

Fast Bridging Finance

-

Low-Cost Bridging Loans

-

Are Bridging Loans Regulated by the FCA?

-

Bridging Finance for Land Developments

-

Bridging Loans Guide

-

Bridging Loans for Residential Homes

-

Can I Get a Bridging Loan as a Second or Third Charge on a Property?

-

Bridging Loan at 100% Loan to Value?

-

Choosing a UK Bridging Finance Lender

-

Commercial Bridging Finance

-

Financing a Property Purchase at Auction

-

Finding Region UK | London Bridging Loans

-

Bridging Loan with Adverse Credit

-

Hotel and Care Home Bridging Loan Products

-

How to Choose a Bridging Loan Broker?

-

Long & Short Term Bridging Finance

-

Revolution Calculator for Bridging Finance Borrowing

-

Bridging Finance on Rental Investments

-

What are the Costs of Applying for a Bridging Loan?

-

What is the Maximum Bridging Loan Available?

-

Which UK Lenders Offer the Cheapest Bridging Loans?

-

Applying For a UK Bridging Loan

-

Bridging Loan with an Adverse Credit

-

Why Use a Broker for a Bridging Loan Application?

-

Finding a New Mortgage After a Precise Mortgages Rejection

-

The Benefits of Broker Advice on the Mortgage Guarantee Scheme

-

Refurbishment Bridging Loans For Property Renovation

Revolution Mortgage Brokers:

100% Independent & Whole-of-Market

As specialist mortgage brokers for a huge variety of applicants, the whole-of-market consultants at Revolution provide access to an exceptional range of lenders, products and mortgage deals. That means you get the advantage of professional negotiation and broker-exclusives through an established lending network to ensure we always find you the most competitive mortgage available.

Ask the Expert

Mortgage Brokers