Is It Worth Overpaying Mortgage: Pros & Cons

Many homeowners wonder whether overpaying their mortgage is a smart move. The question often arises, especially when considering the potential to significantly cut the interest you pay on a capital repayment mortgage.

This article will explore how overpaying could benefit or hinder your financial situation, focusing on clear examples and easy steps to follow. Discover the pros and cons with us.

Understanding Mortgage Overpayments

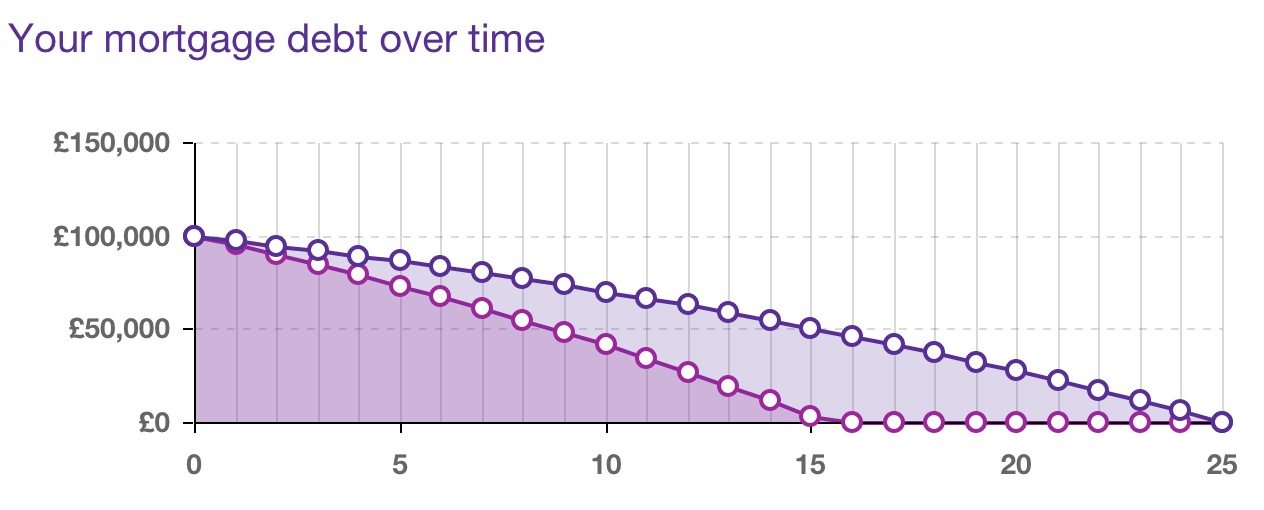

Contributing more funds to your loan repayment than the assigned monthly quantity defines a mortgage overpayment, directly impacting your mortgage debt. This single step can precipitate substantial interest savings and decrease your mortgage period.

What is a mortgage overpayment?

Providing more funds towards a mortgage than the agreed monthly sum defines a mortgage overpayment. Understanding the specifics of your mortgage deal, such as early repayment charges and the timing of the deal’s end, is crucial when considering overpayments. The surplus payment aids directly in the reduction of your loan’s principal, excluding interest.

Overpayments exist in two variations: singular lump sum and habitual overpayments. A lump sum reflects a one-time supplementary payment, while habitual overpayments provide a surplus fixed sum over your typical monthly payments.

Contributing a mortgage overpayment can affect the total interest you incur over time. By curtailing the principal balance promptly, you lower the interest calculation since it depends on the outstanding balance.

Capital repayment mortgages and repayment mortgages permit overpayments, offering loan holders the advantage of alleviating their debt faster than initially planned.

Source: Meaningful Money

How to make a mortgage overpayment

Making a mortgage overpayment can significantly impact your financial future. It lets you pay off your capital repayment mortgage earlier and save on interest. Additionally, understanding the financial markets can help you make informed decisions about overpayments, considering the broader economic fluctuations that influence borrowing costs and mortgage repayment strategies.

- Check your mortgage terms: Look at your agreement to understand if you can make overpayments without facing early repayment charges.

- Contact your lender: Contact them to discuss how you can start making overpayments, whether monthly or in a lump sum.

- Decide the amount: Consider your other financial commitments and how much extra you can afford to pay.

- Make the payment: Make the overpayment using online banking, a cheque, or direct debit, specifying it’s for the capital repayment part of your mortgage.

- Monitor your mortgage balance: Regularly check how these extra payments affect your mortgage capital repayments' term and total interest.

- Adjust if needed: Review and adjust the overpayment amounts accordingly if your financial situation changes.

- Repeat annually: Reviewing and adjusting your repayments yearly helps ensure they align with current financial goals and commitments.

Pros of Overpaying Your Mortgage

Paying more than your required mortgage can drastically cut the interest you owe. It also means you could become mortgage-free and own your home outright much sooner.

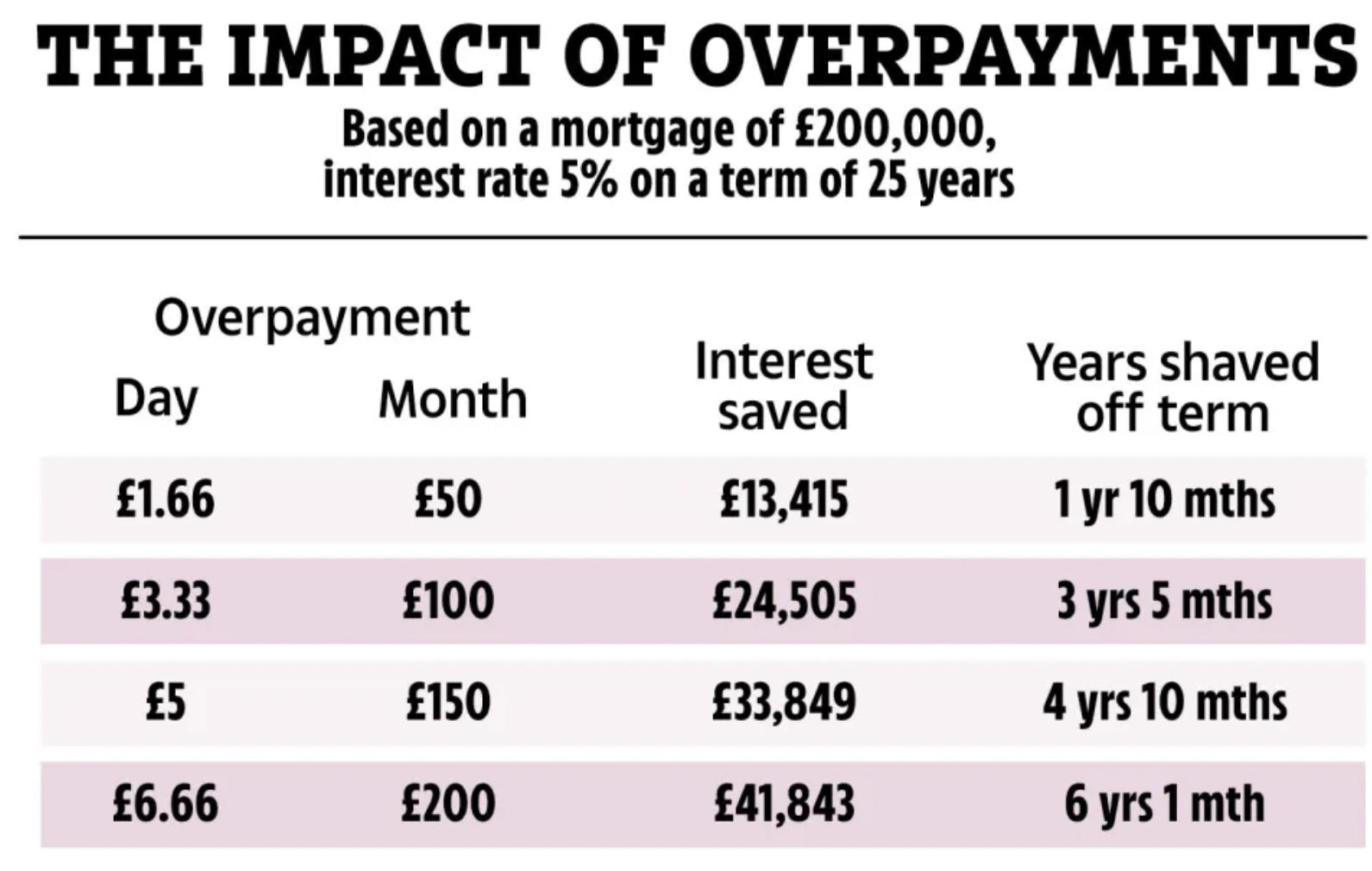

It reduces the overall interest paid

Paying more than the required sum on your mortgage can substantially lower your interest. When deciding whether to overpay a mortgage or save, consider the influence of interest rates. This transpires as, with extra payments, you’re diminishing the primary balance owed more swiftly than expected.

A smaller balance signifies lesser interest accumulation, given that interest is computed based on the leftover amount owed. Supposing an individual possesses a capital repayment mortgage and decides to pay more each month, they straightforwardly lessen the principal sum instead of merely covering the interest.

Source: The Sun

Every pound spent in excess works to lessen future interest expenses. This effective method saves money while promoting fiscal responsibility by reducing extensive term debt responsibilities. It’s comparable to contributing to your financial liberation, wherein every surplus payment brings you nearer to ultimately owning your home earlier rather than later.

It can shorten the mortgage term

Decreasing the total interest you pay invariably leads to another significant benefit: it can reduce the mortgage term. Should you overpay your mortgage, you achieve a reduction in the capital repayment required and also diminish the duration you’re obligated to make mortgage repayments.

This translates into achieving mortgage freedom quicker than initially planned, paving the way for enhanced financial liberty sooner.

For instance, if an individual has a capital and interest mortgage with 20 years remaining and opts to exceed their monthly payments, they could potentially reduce their mortgage term substantially.

This strategy results in savings on impending interest payments and a quicker route to owning their home entirely—a target many aspire to.

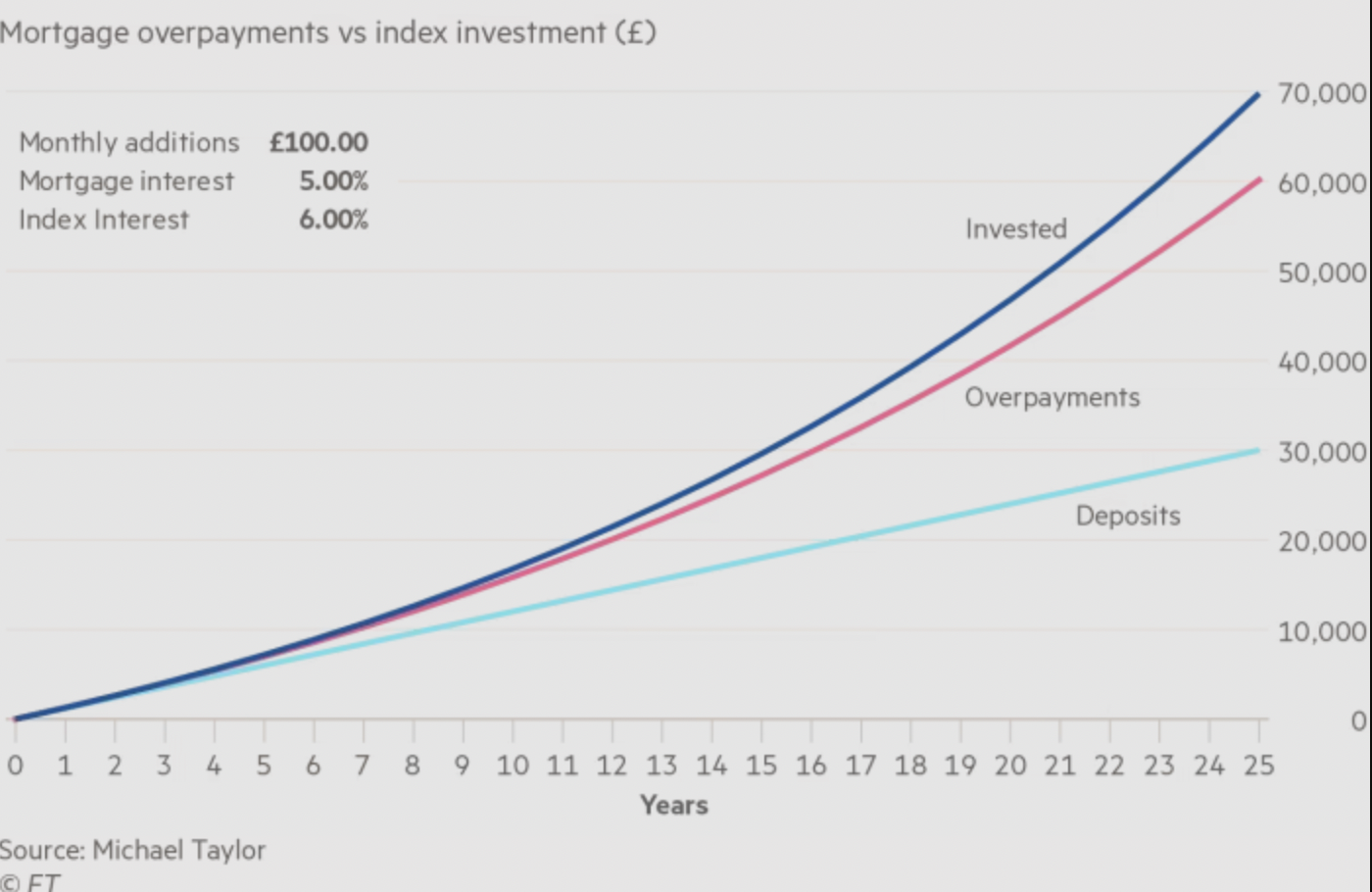

Source: FT.com

Cons of Mortgage Overpayments

While overpaying your mortgage can seem like a solid financial move, it has drawbacks. Early repayment charges and a tighter grip on your liquidity are potential downsides to consider before making extra payments.

Possible early repayment charges

Paying off a mortgage early often seems like a smart move. But banks sometimes charge for this. These are called early repayment charges (ERC). They can take a chunk out of the savings you hoped to make.

ERCs occur because lenders lose interest when you repay early. The cost varies, but it is usually a percentage of the overpayment.

Banks set ERC periods that match your deal's fixed or discounted term. For example, overpaying during a five-year fixed rate could trigger these fees. Read your mortgage terms carefully before making extra payments.

This helps avoid unexpected charges and ensures your overpayments work in your favour.

Reduced liquidity and financial flexibility

While considering early repayment charges, another critical aspect emerges: reduced liquidity and financial flexibility. Tying up extra cash in your home means you have less readily available for emergencies or other investments.

This could pose a risk if your circumstances change unexpectedly. Homeowners should weigh this against the desire to reduce their mortgage term and interest payments.

Overpaying on a capital repayment mortgage impacts your ability to access funds quickly. Should an urgent need arise, such as job loss or significant repairs, the money locked away in mortgage overpayments will only be easy to withdraw with selling the property or taking out loans against it.

Alternative Uses For Your Spare Money

When considering what to do with spare cash, exploring other financial opportunities beyond overpaying your mortgage or saving is essential. Let’s dive into some alternative uses for your extra funds, balancing short-term and long-term goals to maximize your financial situation.

Exploring other financial opportunities

Spare cash can be a powerful tool when used wisely. Here are some smart ways to put your extra money to work:

- Invest in a pension or retirement fund: Contributing to a pension plan can offer significant tax relief and long-term growth, ensuring a comfortable retirement.

- Pay off high-interest debts: If you have credit card balances or personal loans with high interest rates, using your spare cash can reduce your financial burden and save you money in the long run.

- Build an emergency fund: Having a safety net for unexpected expenses can prevent you from going into debt when life throws you a curveball. Aim to save three to six months’ living expenses in an easy-access savings account.

- Invest in stocks and shares ISA: This can be a great way to grow your wealth over time, taking advantage of tax-free returns and the potential for higher gains than traditional savings accounts.

Balancing short-term and long-term goals

When deciding how to use your spare cash, it’s crucial to balance short-term needs and long-term aspirations. Consider the following:

- Short-term goals: Focus on paying off high-interest debts, building an emergency fund, or covering immediate expenses. These steps can provide financial stability and peace of mind.

- Long-term goals: Consider investing in a pension, saving for a down payment on a house, or growing your wealth through investments. These actions can set you up for future financial success.

By carefully balancing your short-term and long-term goals, you can maximize your spare cash and achieve financial stability and growth.

Mortgage Rate and Overpayments

Understanding how interest rates affect overpayment decisions is crucial when considering whether to overpay your mortgage. Let’s explore the relationship between mortgage rates and overpayments and how to make informed decisions.

How interest rates affect overpayment decisions

Mortgage rates play a significant role in determining whether overpaying your mortgage is a good idea. Here’s what you need to consider:

- High mortgage rates: If your mortgage rate is high, overpaying your mortgage can help reduce the interest you pay over time. This can lead to substantial savings and a quicker path to becoming mortgage-free.

- Low mortgage rates: When mortgage rates are low, saving or investing your spare cash might be more beneficial instead of overpaying your mortgage. Low rates mean paying less interest, so your money could earn more in a high-yield savings account or investment.

- Rising interest rates: In an environment of rising interest rates, overpaying your mortgage can become more attractive. By reducing your outstanding mortgage balance, you can mitigate the impact of higher interest costs in the future.

By understanding how interest rates affect overpayment decisions, you can make informed choices about using your spare cash and achieving your financial goals. Whether you decide to overpay your mortgage or explore other economic opportunities, aligning your actions with your overall financial strategy is critical.

Conclusion

Deciding to overpay your mortgage is a complex choice. While it can bring benefits like lower interest costs and a shorter mortgage term, it also means facing possible charges and having less cash.

Every homeowner's situation is unique. You must carefully weigh the pros and cons before making this decision, which can significantly impact your financial future.

Related Posts

Ask the Expert

Mortgage Brokers