What Are The Disadvantages Of Being Tenants In Common?

Joint tenancy and tenants in common both deal with sharing a house or land, but they have key differences like how you share ownership and what happens if one owner passes away. Curious to learn more? Keep reading!

Definition of each

In joint tenancy, all owners have equal rights to the entire property. This means each person can use the whole space and has a say in what happens to it. If one owner dies, their share goes directly to the remaining owners through a process called right of survivorship.

This makes things simpler when dealing with inheritance since the property doesn't go through probate.

Tenants in common have more flexibility in owning property because they don't have to own equal parts. One person could own 60%, while another owns 40%. Their shares correspond to their investment or a joint tenancy agreement, not a set rule.

They can also leave their part of the property to anyone they choose in their will, making this option popular for investment properties or friends buying together.

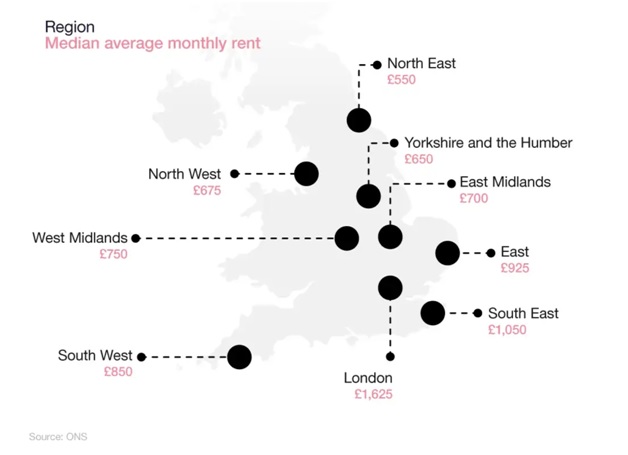

Did you know that as of 2023, almost a fifth (18.8%) of UK homes are privately rented? Here is a breakdown of the median average monthly rent across the UK.

Image Source: Uswitch

If you want to see how much you can borrow today, click the button below.

CALCULATE HOW MUCH YOU CAN BORROW

Differences and similarities

Moving from the definitions, let's explore how a joint tenant differs from tenants in common and what they share. Joint owner arrangement means that if one owner dies, their part of the property automatically goes to the other owner.

But with tenants in common, when one owner passes away, their portion of the property gets passed down to their heirs or as stated in their will. Another key difference lies in how they split property upon separation: joint tenants always divide it equally, while tenants in no way are restricted to equal shares - offering flexibility and possibly more tax efficiency.

Despite these differences, both types of joint ownership require names on the deed of trust and might involve taking out a mortgage with another person. They also need to handle real estate taxes together regardless of their ownership shares.

Furthermore, both can benefit from legal advice for better understanding rights and responsibilities involved with land registry practices or when drafting a cohabitation agreement for home ownership—making sure all parties understand everything about the property title before entering into such arrangements.

The Disadvantages of Tenants in Common

Sharing a house title as tenants in common means everyone owns a piece of the property, but this comes with its own set of challenges. Each owner must handle equal parts of the mortgage and upkeep, yet when one person wants to sell their share or passes away, things can get complicated.

Unlike beneficial joint tenants, there's no simple pass-over of ownership to the other owners if someone dies; instead, that portion goes into their will and testament process. This setup can lead to disagreements among co-owners over sales or changes to the building.

Knowing about these issues helps you prepare for owning real estate with others. Keep reading to learn how you might avoid these pitfalls while still getting into the housing market together.

Equal ownership responsibilities

In a tenancy in common agreement, every owner must handle their share of ownership duties. This often includes paying property taxes, managing any mortgage responsibilities, and handling upkeep costs for the real property.

If one tenant decides to ignore these obligations, it can lead to financial stress for the other tenants as they might have to cover missing payments to avoid issues with the mortgage lender or tax authorities.

Owners also face joint and several liability when dealing with debts or legal action against the property. This means if someone sues over an incident that occurs on the property, all owners could be held accountable even if only one was at fault.

The same goes for any unpaid debts related to the property; creditors can seek repayment from any or all of those involved in owning without dividing responsibility equally among them.

No automatic right of survivorship

Owning property as tenants in common means there's no automatic right for your share to go directly to the other owners if you pass away. Instead, your part of the property becomes part of your estate.

This could lead to it being handled according to a will or state laws if there isn't one. It complicates things because heirs or beneficiaries might end up co-owning with someone they didn't choose.

This setup affects planning for future expenses like inheritance tax and can influence decisions on taking out a mortgage with tenants in common. If one owner dies, their beneficiaries must deal with capital gains tax and potentially dispute over how the property gets managed or whether it should be sold.

Such situations might require legal advice, involving solicitors who understand deeds, estate planning, and partition actions where court orders divide joint properties among owners or heirs.

Ability to sell share without consent

One major downside of tenants-in-common properties is the ability to sell a share without needing consent from the other owners. This option means any owner can decide to sell their portion of the property whenever they want to anyone they choose.

It opens up the possibility for new co-owners who may have different ideas and intentions about the property management, which could lead to conflicts.

This feature also impacts conveyancing - transferring ownership of a property - because it introduces more complexity into what might otherwise be straightforward transactions. For instance, if one tenant in common wants out, they don't need permission from others but must navigate through legal processes involving deeds of transfer and possibly mortgages on the shared property.

New owners stepping in could alter the loan-to-value ratio or affect agreements previously made among original co-owners, posing financial risks or challenges that were not initially anticipated.

Potential conflicts with co-owners

Conflicts often arise between co-owners when decisions about the property do not align. If one partner wants to sell their share or make significant changes, disagreements may occur if the other owners do not agree.

These disputes can escalate, leading to a need for legal action or intervention by solicitors regulated by the Solicitors Regulation Authority. Such scenarios highlight the importance of having clear agreements and understanding among all parties involved in tenants in common properties.

Another source of conflict is related to inheritance issues. Partners may have different ideas about who should inherit their share of the property, especially in situations involving blended families with children from previous marriages.

Disagreements can also surface when it comes time to manage expenses like mortgage payments, taxes, and maintenance costs. All owners must contribute their fair share since these responsibilities fall on them equally according to ownership interests defined in deeds of transfer or tenancy agreements.

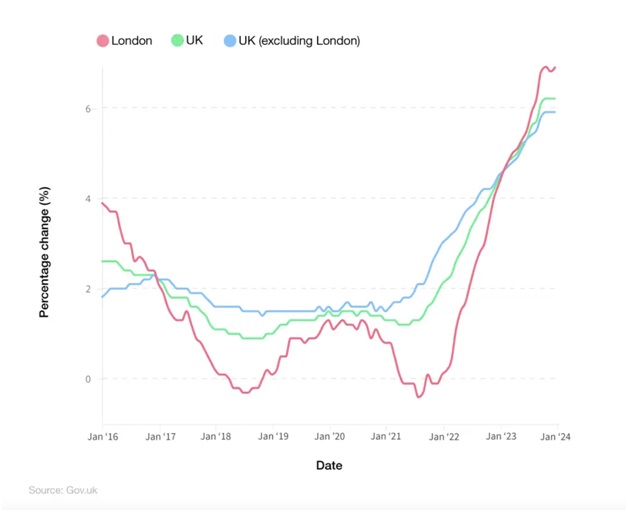

Caption: Here is a year-to-year summary of UK rental price changes between 2016 and 2024.

Source: Uswitch

Mitigating Risks as Tenants in Common

Understanding how to lower risks when you share ownership in a property is key. Doing your homework on who else owns the building with you can prevent future headaches. Creating a strong legal document that outlines everyone's rights and duties helps keep things fair and square between all owners.

It's also wise to talk to a property law expert for guidance. This step ensures you're not stepping into risky waters without knowing what lies ahead.

Researching co-owners

Before deciding on a tenants in common agreement, it's crucial to do thorough research on potential co-owners. You want to ensure they have a reliable financial history and share similar views on property management.

Use tools like property management software to check their past dealings with real estate or any red flags such as bankruptcies or evictions. This step can prevent future conflicts and ensure smoother joint property ownership.

Securing legal advice is also vital in understanding the full scope of what being tenants in common entails, including aspects related to taxes, mortgage responsibilities, and eviction procedures if things go south.

A lawyer can help draft a deed of transfer that clearly outlines each owner’s undivided interest and what happens if someone wants out. This careful approach protects your investment and promotes harmony among co-owners, keeping everyone informed about their rights and obligations under this civil partnership arrangement.

Having a well-drafted agreement

After you've done your homework on potential joint owners, the next crucial step is to ensure there's a well-drafted agreement in place. This contract, ideally prepared by a skilled real estate attorney, sets clear rules for how ownership interest is managed and outlines steps for resolving any disputes.

It acts like a guidebook for the shared adventure of fractional ownership. Such agreements cover everything from how taxes are handled to what happens if someone wants out.

Creating this document requires considering all possible scenarios: What if one owner falls behind on mortgage payments? How will the rental income tax be affected? The agreement also details the process for adding or removing co-ownership names on deeds of trust, providing stability and protecting everyone involved.

Having these guidelines prevents misunderstandings and ensures that all parties know their financial responsibilities and rights regarding the property they share. This careful planning makes being tenants in common less risky and helps maintain peace among owners over time.

Need help securing the borrowing you need at the most competitive rates available?

FAQs

1. What does being tenants in common mean?

Being tenants in common means two or more people have ownership interest in a property. Each person owns a specific share, which can be different sizes.

2. Are there any financial disadvantages to being tenants in common?

Yes, one major disadvantage is the tax implications. Depending on your tax bracket and how much income you earn from rental of the property, you might find yourself taxed heavily as HMRC views each owner's share as individual income.

3. Can being a tenant in common affect my mortgage options?

Absolutely! If one party has poor credit, it may impact the LTV ratio that lenders are willing to offer for a mortgage on the property.

Related Posts

Ask the Expert

Mortgage Brokers