Why the 18-year property cycle is so important? Part 1

How to recognise, prepare for and profit from the property cycle

1. Introduction to the property cycle That's all very well, but how can you use the property cycle to make money?

The 18-year property cycle is one of the most important things you should get to grips with as an investor. If you understand the cycle, you can avoid making decisions that you may come to regret later.

The economy is never a stable entity, but always in a state of flux. If you step back and look at the peaks and troughs over time, it's easy to see a pattern, and you might wonder why recessions weren't prevented in the first place. All the economic nous in the world won't prevent another crash happening, but we can be prepared when it does, and know not to get too excited and run away with the crowd when there is a property boom.

Over the next three articles, we'll explain the property cycle so you can recognise each stage and make informed decisions.

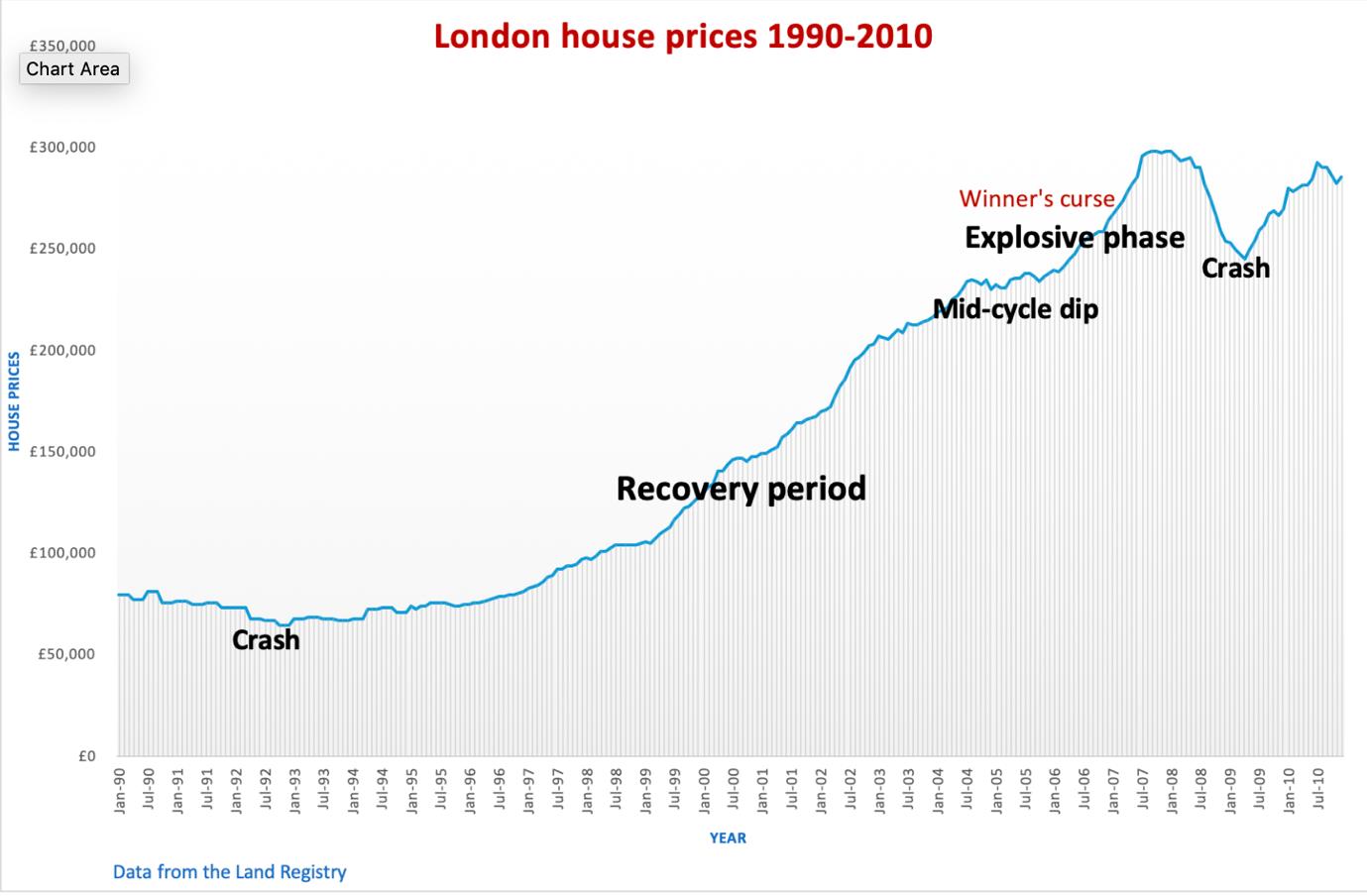

Although it's impossible to predict the future, we do know that property prices will always rise in the long run, despite periods of volatility along the way. There are exceptions to the rule, but we'll structure the theory based on London house prices.

Why is there a property cycle?

Property prices are cyclical because the demand, especially in cities, outstrips the supply. The price of most other goods and services rise gradually over time, in line with inflation, and never really change that much. The price of bread doesn't fluctuate, and if the demand were to increase, the price of a loaf wouldn't increase that much because it's easy to make more. The raw ingredients are readily available and replenishable.

If you want a house in London, there is only a finite amount of land on which it can be built and the majority of people want to live in established areas, close to amenities and work.

You can't create more land; so as the economy grows, the demand increases and property prices rise. During an economic boom, there's an added increase for more homes, factories, shops and places of entertainment, and major building projects get underway. The nation's confidence rises along with the GDP. As prices rise, more and more people want to buy property because it looks like such a lucrative investment. Banks are happy to lend money which is secured against highly-priced property and lending terms are relaxed, making it easier for more people to borrow money.

Property increases at a rate disproportionate to wages, and the average person can't afford to buy a house. Property prices fall, banks stop lending money and building projects cease. The wider economy is in crisis as businesses close and unemployment rises. But just as the boom isn't sustainable, neither is the bust. Eventually things return to normal, banks start lending and the cycle once again begins.

But there is always an upward trajectory and there is no better example than in London. When house prices fell following the 2008 financial crisis (caused by deregulation and over-leveraging), it didn't take long for them to bounce back, but some other parts of the country are still feeling the effects of the crash. Some property prices in the north east of England are still around £10,000 lower than they were in 2007. Prices rose steeply in the years leading up to the crash, and remain at the same point they were before the explosive phase.

Boom and bust

There are few things that we can be certain of in life, but we can be pretty sure that the house prices (and therefore the economy) will steadily rise over time, although it might not always look like it when there are periods of fluctuation. The public and the media get caught up in the excitement of change. Some of these headlines during peaks and troughs can thwart public perception, because the headlines don't take into account the longer-term financial cycle. We can't accurately predict the future, but we can learn a lot from the past.

The 18-year cycle theory was first coined by economist Homer Hoyt, who found a degree of predictability in land prices for sale. The theory was later used by Fred Harrison, who recognised patterns based on slumps in 1953-4, 1971-2 and 1989-90.

In 2005, Harrison predicted that another crash would happen 2007-8 and he got that right.

It's not an exact science and it doesn't happen exactly every 18 years, but it is generally identified as a crash, followed by a recovery period of four to five years, a few years of steady growth that includes a slight wobble, followed by a huge boom, and then we're back to where we started with a crash.

Most of us can remember what happened in 2008, and maybe further back in 1992 or the early 1970s, and there are many who, in hindsight, wish they'd acted differently. It's easy enough to get swept up with the excitement of a boom or the panic of a recession, but if you know what stage of the cycle you are in, you can time your investments by predicting what will happen in the wider economy.

Our next article looks at the different stages of the cycle and how to recognise them. Finally, we look at how to apply the theory successfully to your own investments.

Contact Revolution Brokers for free advice in Essex, Kent, London and Hertfordshire.

Related Posts

Ask the Expert

Mortgage Brokers