Where are the Best Areas In the UK For Buy-to-Let Investors In 2023?

.webp) Whole of market brokers

Whole of market brokers

.webp) Mortgage that suits you

Mortgage that suits you

.webp) On time customer support

On time customer support

Are you pondering the possibility of embarking on a journey into the world of buy-to-let investments in the UK during this year of opportunity? If such contemplations reside within your mind, prepare yourself for an exhilarating odyssey! In the month of March 2023, Zoopla unveiled a comprehensive market report, unfurling a vivid and intricate tapestry that offers profound insights into the intricate landscape of buy-to-let investments. Let's dive into it and explore what's happening in a way that's as friendly and informative as chatting with a knowledgeable friend.

Rising Rental Premiums - A Promising Start

According to Zoopla's report, the UK's buy-to-let rental market has been on a remarkable upswing. Overall rental inflation has reached 11.1%, which is impressive. While this number reflects a minor decrease from its 12.3% position in mid-2022, the true narrative emerges from the fact that premiums have surged by a substantial 20% in the past three years.

Now, this might sound like music to the ears of existing landlords. However, there's a twist in the tale. Zoopla's report also predicts a slowdown in rental inflation by the end of the year, with estimates hovering around 4% to 5%. This change is expected to be more pronounced in areas that have traditionally experienced the highest rent growth – think inner London and other bustling city centres.

The Search for the Best Returns

Now, what does this divergence in regions signify for individuals in pursuit of their next (or maiden) buy-to-let investment venture? It implies that you must be prepared to delve into diligent research, ascertaining the optimal locations within the UK where you can anticipate the most favourable returns on your investment.

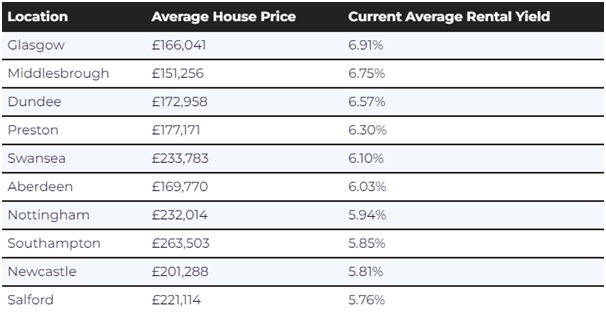

Top 10 UK Cities and Towns for Rental Yields

If you're all about chasing those rental yield figures, we've got some pointers for you. Consider exploring the following areas:

What's common among all these locations, with the exception of Southampton? Their average house prices are below the current national average of £257,122. In cities like Glasgow, Middlesbrough, Dundee, and Preston, they are significantly lower. Investing here not only offers promising rental yields but also represents excellent value for money when it comes to property prices.

Taking a Deeper Dive - Aldermore Bank's Buy-To-Let City Tracker

But wait, there's more to consider than just rental yields. Aldermore Bank's Buy-To-Let City Tracker index takes a comprehensive look at various indicators to evaluate towns and cities across the UK. These include:

- Average overall rent (per room per month)

- Short-term rental yield returns

- Long-term house price increases

- Vacancy rates versus housing stock

- The current population in the rental market

After analysing these factors, Aldermore's most recent tracker index update (as of January 2023) arrived at the following top ten locations for buy-to-let investors:

Manchester claimed the top spot, primarily due to its long-term property value growth (a 5.6% increase) and a substantial rental market share (31%).

London scored high thanks to its impressive average overall room rent (£660 per month) and a healthy percentage of the population (29%) active in the rental market. However, short-term rental yields in the capital are relatively steady at 5.1% compared to other top-ten areas.

Places like Peterborough, Milton Keynes, Southend, and Cambridge, while being within commutable distance from London, offer cost-effective alternatives for both renters and buy-to-let investors seeking more budget-friendly property prices.

What's Your Next Move?

Researching the ideal spot for your buy-to-let investment can be quite the task. With a constantly changing landscape, it's not always easy to be sure if you're making the right decision. That's where a smart move comes in – seeking the guidance of an experienced buy-to-let mortgage broker.

Our free broker-matching service is here to connect you with a specialist in this field. They not only help you identify the best buy-to-let mortgage brokers options but also possess the knowledge to pinpoint the most promising areas for your investment. It's like having a wise friend by your side throughout this exciting journey. So, are you ready to explore the world of buy-to-let investments in 2023? Your adventure starts now!

Will Mortgage Rates Go Down In 2024?

Wondering if mortgage rates will drop next year? Recent trends suggest that the average mortgage interest rate is on a slight decline. Our blog offers insights into what's predicted for 2024, giving you strategies to secure the best possible rate. Keep reading to find out more! Key Takeaways Mortgage rates in 2024 are expected..

Read moreUnderstanding Mortgage Income Multiples In The UK: How Many Times Your Salary Can You Borrow?

Are you wondering how much you can borrow for a mortgage based on your salary in the UK? It's known that lenders offer mortgages up to 6 times your annual income, which is crucial for buying in expensive areas. This blog will guide you through understanding higher income multiple mortgages and how they determine what you can borrow. Ke..

Read moreLatest Flexible Mortgage News: Lenders Offering More Options For Borrowers

Many people in the UK are dealing with mortgage worries. Chancellor Jeremy Hunt has promised more help from banks, and the latest flexible mortgage news shows that lenders are also being more flexible. Lenders Offering More Flexibility to Mortgage Borrowers Mortgage lenders are making it easier for homeowners to tweak their payment ..

Read moreFCA disclaimer

The content included in our articles, blogs, web pages and news publications is based on information accurate at the time of writing. Note that policies and criteria can change regularly throughout the UK mortgage lending market, and it remains essential to contact the consultation team to receive up to date guidance. The information included on the Revolution Brokers site is not bespoke to any circumstances or individual application scenarios and therefore is not intended to be used as financial advice. The content we share is designed to be informative and helpful but cannot be relied upon to provide individual advice relevant to your mortgage requirements. All Revolution team members are fully qualified, trained and experienced to provide mortgage advice of an independent nature.

We collaborate with lenders and providers who are regulated, authorised and registered with the Financial Conduct Authority (FCA). Should you require specific mortgage borrowing types, some products such as buy to let mortgages may not be FCA regulated. The Revolution team can provide further information about regulated and unregulated lending as required. Please remember that a mortgage is a debt which is secured against your home or property. Your home can be at risk of repossession if you do not keep up with the repayments or encounter any other difficulties in managing your mortgage borrowing responsibly. This also applies to any remortgage or home loan secured against your property, including equity release products.